Related Parties Transactions Policy

1. PURPOSE

1.1. This Policy for Related-Party Transactions (“Policy”) establishes the main procedures to be followed by Romi S.A. (“ROMI or Company”), its controlled, affiliated companies, which have common members in the management, in short, any companies in which the Company may exercise or be influenced by, as well as by its employees, directors, shareholders and persons related to them, in the performance of transactions with related parties and in situations where there is a potential conflict of interest.

1.2. The main purpose of this Policy is to establish rules for carrying out related-party transactions, in order to ensure management’s decision making in an appropriate and diligent manner, enabling the Company to monitor and manage potential conflicts of interest arising from such transactions, to ensure that these are conducted within market parameters, under commutative conditions, as well as that they are disclosed and reflected in the Company’s reports, in accordance with the applicable rules and best corporate governance practices.

2. COMPLIANCE WITH REGULATIONS

2.1. This Policy is in line with the requirements of Law No. 6404/76, particularly under Article 155, which determines that the manager must act with loyalty, demanding that the interests of the Company overlap with the interests of decision-makers (duty of loyalty of the directors towards the Company).

2.2. Pursuant to Article 156 of the aforementioned law, if there is a conflict of interest, it is incumbent upon the director to inform the others of the conflict situation, as well as to the Board of Directors, which becomes prevented from intervening in the operation and has to include in the minutes of the Board of Directors the nature and extent of its interest.

2.3. The Policy is an integral part of the Company’s Code of Ethics and Business Conduct (“Code of Ethics”).

3. MAIN DEFINITIONS

3.1. Below are the main definitions necessary for the correct understanding of this Policy.

| Termo | Definição |

| Significant Influence | Significant influence is understood as the power to participate in the Company’s financial and operational decisions, which can be obtained through shareholding, statutory provisions, shareholders’ agreement, position, role, or any other form that allows to interfere in decisions of the Company’s management, even if there is no direct or indirect participation in its capital. |

| Related Party | For the purposes of this Policy, the definition of related party and related-party transaction are those used by the Brazilian Securities and Exchange Commission (“CVM”), pursuant to CVM Resolution No. 560, of December 11, 2008, which approved Technical Pronouncement CPC No. 05 (“CPC 05”). According to CPC 05, related parties are people who are related to the Company:

(a) Directly or indirectly through one or more intermediaries, when the party: (i) controls, is controlled by, or is under the common control of the Company (this includes parent companies or subsidiaries); (ii) has an interest in the Company that gives it significant influence over the Company; or (iii) has joint control over the Company; (b) If it is an affiliate of the Company; (c) If it is a joint venture in which the Company is an investor; (d) If it is a member of the key management personnel of the Company or its parent company, and the key management personnel are those who have authority and responsibility for planning, directing and controlling the Company’s activities, directly or indirectly, including any director (executive or otherwise) of that entity; (e) If it is a close member of the family or of any person referred to in subitems (a) or (d) above, and a close family member means those family members who are expected to influence or be influenced by that person in their business with the entity, may include: (i) its spouse or partner and children; (ii) the children of its spouse or partner; and (iii) its dependents or those of its spouse. (f) If it is a controlled entity, jointly controlled or significantly influenced by, or where the significant voting power in that entity resides, directly or indirectly, in any person referred to in subitems (d) or (e); or (g) if it is a post-employment benefit plan for the benefit of the entity’s employees, or any entity that is a related party to that entity. |

| Related-Party Transactions | Pursuant to CPC 05, “Related-Party transactions is the transfer of resources, services or obligations between related parties regardless of whether or not a value is allocated to the transaction.” |

| Market Conditions | These are the conditions for which, during the negotiation, the principles of competitiveness (prices and conditions compatible with those practiced in the market) and compliance (adherence to the contractual terms and responsibilities practiced by the Company, as well as appropriate information security controls). |

| List of Related Parties | It is the list of Related Parties identified by the Company, its Directors, and each of the main Related Parties identified by the Company, which will serve as a reference for analyzing transactions with related parties. |

| Director | These are the Officers and/or members of the Board of Directors referred to individually or in the plural. For the purposes of this Policy, members of its Fiscal Committee and Advisory Council, when installed, or any other advisory bodies of the Company, will be treated as members of the Company. |

![]() 4. COVERAGE, ADHESION, AND DISCLOSURE

4. COVERAGE, ADHESION, AND DISCLOSURE

4.1. This Policy applies to all employees and directors of the Company, its affiliates and controlled companies. The Executive Board must disclose this Policy to the Company’s employees and ensure compliance with it.

4.2. In addition to this Policy, the Company’s employees and Directors must comply with the provisions of the Code of Ethics.

4.3. The members of the Management and of the Ethics and Business Conduct Committee will formalize the adhesion to this Policy through their signature in the instrument of adherence (Exhibit I).

5. ETHICS AND BUSINESS CONDUCT COMMITTEE

5.1. In order to assist in ensuring that the guidelines established in this document are complied with, the Ethics and Business Conduct Committee (“Committee”) will be appointed, coordinated, and will function, be composed of and perform under the terms of its Bylaws.

5.2. The Committee is also responsible for keeping the instruments of adherence duly signed, according to the model in Exhibit I, and for coordinating with those involved and maintaining the database of the Company’s related parties, which shall be used to determine the transactions subject to the guidelines of this Policy (“List of Related Parties”).

5.3. The Committee can also assist in defining the process and documentation necessary to formalize related-party transactions.

6. APPROVAL

6.1. Related-party transactions shall have their own approval scope, according to the limit amounts for approval by the Executive Board previously authorized by the Board of Directors, specific for related-party transactions, updated periodically (Company’s Internal Instruction No. 12.99-3-0452.A), noting that: (i) any related-party transaction, regardless of the amount involved, must be submitted for validation by the responsible Officer together with the Chief Executive Officer, and (ii) any transaction with a Director, regardless of the amount, must necessarily be submitted for approval by the Board of Directors.

7. PROCEEDING

7.1. In negotiations related to related-party transactions, the same principles and rules that guide any transactions carried out by the Company with third parties in general, the rules established in the Company’s Code of Ethics and Business Conduct, the Articles of Incorporation, management decisions, internal policies and regulations, as well as legislation, must be complied with.

7.2. Related-party transactions must also be in market conditions, commutative and comply with this Policy.

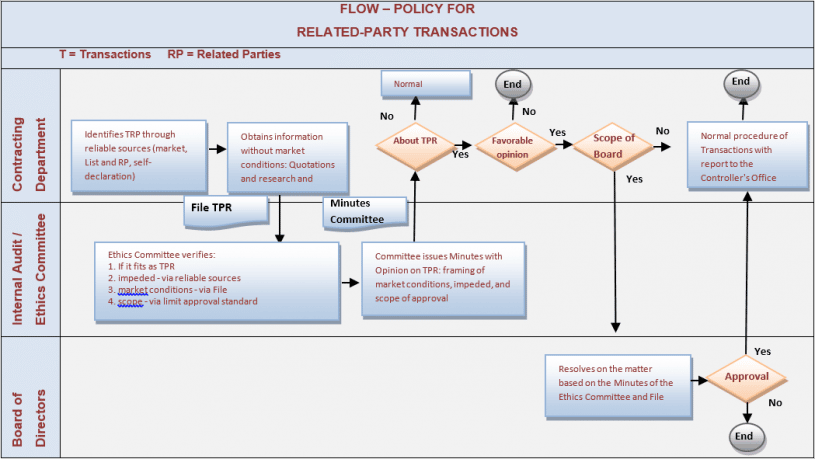

7.3. The main processes and assumptions designed below shall be complied with in related-party transactions:

![]() a) The transaction requesting department

a) The transaction requesting department

(a.i) shall identify it as a related-party transaction, using any reliable source, such as information obtained in the market, self-declaration of the party, or List of Related Parties organized by the Committee,

(a.ii) shall provide a request for proposals to two (2) more companies with similar technical expertise, and the conditions that best meet the purpose of the contract shall prevail; cases that allow a single bidder and that this is a related party shall be detailed and adequately justified and be subject to specific assessment by the Committee and/or Board of Directors, and

(a.iii) shall provide a Related-Party Transaction File containing the information related to items “a.i” and “a.ii” above, to be sent to the Committee;

b) The Committee shall evaluate the Related-Party Transaction and issue minutes, pursuant to this Policy and its Bylaws, to the requesting department with a copy to its Executive Board, containing

(b.i) suitability or not (and reason) of the transaction as a Related-Party Transaction

(b.ii) an analysis of whether or not the market conditions of the related-party transactions analyzed were met,

(b.iii) any members of the Management who are prevented from participating in discussions and/or decisions on the matter, and

(b.iv) level of approval of such transaction (Board of Directors or Executive Board), as defined, observing that if such transaction involves a Director, it must necessarily be submitted to resolution by the Board of Directors.

c) The requesting department, depending on the content of the Committee’s Minutes, will decide whether or not to proceed with such transaction or will forward it to the Board of Directors for deliberation, according to the scope of decision;

d) All related-party transactions shall be executed in writing, through a specific instrument (preferably an agreement), specifying its main characteristics and conditions, such as price, terms, guarantees, taxes, among others that are necessary for the specificity of the intended business;

e) If additional market assessment is needed, by the Committee and/or the Board of Directors, related-party transactions shall be based on independent appraisal reports, prepared based on realistic assumptions and information referenced by third parties, and it may not be based on parties involved in the operation, whether they are banks, lawyers, specialized consulting companies or other companies;

f) A copy of the formalization instrument for the related-party transaction, as well as the Minutes of the Committee, shall be immediately sent to the Controller’s Office, to ensure that this is reflected in the Company’s reports and disclosed in accordance with the applicable rules.

8. CONFLICT OF INTEREST

8.1. In relation to any conflicts of interest in the transactions with respect to the members of the Committee, or Directors, the member must refrain from discussing the matter in question and shall immediately inform the Committee of the eventual conflict.

8.2. In situations where related-party transactions require approval by the Shareholders’ Meeting or by the Company’s Board of Directors, if any member is prevented from deliberating on the matter due to a potential conflict of interest, the member must declare to be prevented and may not have access to information or participate in meetings related to matters in which it has or represents a conflicting interest with the Company. Such participant may be called only to provide the necessary clarifications, but will not participate in the discussion of the subject and will not deliberate on it. The impediment shall appear in the minutes of the Board of Directors’ meeting or the Shareholders’ Meeting.

8.3. In the event of manifestations by the members of the Shareholders’ or Board of Directors’ Meetings about the alleged conflict of interests of the Shareholder or Director, whose vote has been counted, the Chairman of the Shareholders’ or Board of Directors’ Meeting shall receive and process the allegations, without prejudice to the legal provisions on the annulment of the decision.

9. PROHIBITIONS

9.1. The following related-party transactions are expressly prohibited:

• Those carried out in conditions adverse to those of the market in order to harm the Company’s interests;

• Participation of directors and employees in businesses of a special or personal nature that interfere or conflict with the interests of the Company or that result in the use of confidential information obtained by virtue of the exercise of the position or office held in the Company;

• Made to the detriment of the Company, favoring an affiliated, controlled or controlling company, and the transactions between such parties must observe strictly commutative conditions;

• Those not within the Company’s corporate purpose and/or without observing the limits provided for in the Articles of Incorporation and in the rules set by the Company’s Management;

• Granting of loans and guarantees to Shareholders, Controllers, and Directors (except loans to Directors, as defined in this Policy, who are employees of the Company, under the terms of the internal Policy).

10. DISCLOSURE

10.1. Management must promote wide disclosure to the market of transactions between the Company and its related parties, with sufficient and complete information, in accordance with the regulations in force, allowing shareholders to inspect and monitor the Company’s management acts.

10.2. The transactions shall be disclosed in accordance with the applicable accounting principles and shall comply with the disclosure provided for in the Novo Mercado Listing Regulation of B3 S.A. Bolsa, Brasil, Balcão, with respect, in particular, to the additional requirements of the quarterly periodic information (ITR’s) and also pursuant to CVM Instruction 480/2009 (reference form).

10.3. The Controllership Department must promote full and correct disclosure in the Financial Statements notes and the Investor Relations Department in the Reference Form.

10.4. The Internal Audit Department shall conduct periodic and objective reviews of related-party transactions as part of its annual work plan. The reviews shall aim to evaluate and monitor the adequacy and correct disclosure of the transactions carried out. Possible exceptions found shall be reported directly to the Committee.

11. VIOLATIONS

11.1. Possible violations of the terms of this Policy shall be analyzed by the Committee, with the consequent submission to the Board of Directors, if applicable, which shall adopt the necessary measures, as well as warn that certain conducts may constitute a crime, subjecting those responsible to the penalties provided for in the current legislation. Omissions related to this Policy shall be submitted to the Company Committee, which shall also evaluate its submission to the Board of Directors.

12. APPROVAL, TERM OF EFFECTIVENESS, AND AMENDMENTS

12.1. This Policy was approved by the Company’s Board of Directors at a meeting held on December 10, 2019, and will become valid on March 2, 2020, for an indefinite period, until a resolution to the contrary is approved, which can be found on the company’s website: https://www.romi.com.

12.2. In case of doubts about the application or interpretation of this Policy, the Legal and Compliance Department should be consulted.

12.3. Updates to this Policy, when necessary, shall be previously evaluated by the Audit Committee and submitted to the Board of Directors for deliberation.

EXHIBIT I. INSTRUMENT OF ADHERENCE TO THE POLICY

I [name and qualification], REPRESENT that I am aware of the terms and conditions of the Policy for Related-Party Transactions of Romi S.A., and formalize my adhesion to this policy, committing myself to disclose its purposes and to comply with all its terms and conditions.

Santa Bárbara d’Oeste, [date]

Name: